Trump recently declared, as reported by many news outlets, such as CNBC, that he is not satisfied with the Democrat-supported bill giving $600 to qualifying Americans. Instead, Trump has declared he wants it to be $2000 per person.

President Donald Trump is demanding lawmakers raise the second round of stimulus checks to $2,000 per person, from $600.

“I am asking Congress to amend this bill and increase the ridiculously low $600 to $2,000, or $4,000 for a couple,” Trump said in a video posted to Twitter Tuesday night.

While the president did not outright threaten a veto of the $900 billion Covid relief bill, he did call it an unsuitable “disgrace.”

But if you are one of the people eligible for a stimulus check, don’t get your hopes up. The legislation passed both houses of Congress with veto-proof majorities, meaning that Trump is powerless to raise direct payments from $600.

Still, the top Democrats in Congress, House Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer, said they would support getting bigger checks to people.

“Democrats are ready to bring this to the Floor this week by unanimous consent. Let’s do it!” Pelosi tweeted.

A senior Democratic aide told CNBC that House Democrats will attempt to pass a standalone bill for $2,000 direct payments on Thursday, though it is unclear whether this would pass a Republican-led Senate, or even receive the unanimous consent necessary in the House.

Lawmakers calling for a vote on this standalone measure have not specified whether this would be in addition to the $600 second stimulus check, or would instead replace it. (source)

You know, sometimes even the news surprises me.

I said this before, and I will say it again, and they are several points.

-The ONLY tool in the government “policy” box for money is to PRINT MORE MONEY

-Printing money DOES NOT CREATE WEALTH, it only artificially supports stock prices (preventing devaluation of companies and those holding large stock holding) while causing all other commodities to skyrocket in price, and save for hard assets that preserve value by their inherent nature (such as gold or silver), it destroys people who worked hard and saved their money because the VALUE of money comes from scarcity, and if money is as common as toilet paper, it becomes worth exactly that.

-When the value of money itself declines, this is NOT inflation. Inflation is the disproportionate rise in prices due to demand that overvalues them. This is the opposite, but the destruction of value in the means of exchange, which is known as hyperinflation.

-Trump is doing what ALL OTHER PRESIDENTS have done, regardless of party, because apart from disowning the debt, this is the ONLY TOOL that he has

-Whoever is in office on January 7th will continue the EXACT SAME POLICIES because THIS IS ALL THEY CAN DO.

I am going to reprint my hyperinflation article again below. I am doing this because people NEED to understand what is happening.

Until that time, as I have said before, keep earning money, but look for ways to PRESERVE value, because the printing CANNOT stop for political reasons, lest the dollar itself collapse. This is not alarmism, but basic economic reality that would apply to any other nation in any time in history given the same circumstances. It is not the people who have money invested in assets that have intrinsic value that have money, but the good-hearted man who saved for his whole life that will be hurt, because printing money apart from the generation of actual value to back it up (such as the famous “gold standard”) means that value must decline in the fiat currency until it reaches the value of the paper it is printed on.

I’m not saying ‘hyperinflation is happening’. That would be obvious if it was. I am saying that we are following the same road that leads to it as Chile, Germany, Russia, and many other nations have, and we would be very prudent to give attention to what is happening lest Americans become victims to the lessons of history.

I’m going to also say again, I DON’T WANT THIS, and I hope in ten years, we can say that I was wrong. However, I have yet to see a challenge to my position that makes sense given the conditions.

***

***

***

Explaining How Hyperinflation Could Come To The US

There are no Americans alive today who remember as older adults the Great Depression. I speak of working men in their thirties or forties already on jobs here. By comparison, the Great Depression was very short, since from the decadence of the 1920s to the crash of 1929, and then twelve years to the entrance of the US in a serious way into World War II, the time from misery to true recovery was twelve years. In fact, the US recovered so well that massive industries grew, people found work, debt was paid down, families were able to settle down, and the country truly grew. The US victory in World War II that followed took the World War II induced economic boom and amplified it many times over, providing a wave of true prosperity that ushered in a small “golden age” in America which lasted until about 1965 if one considers the true effects, and until 2007 if one considers the expansion of credit as a way to prolong the economic effects of World War II through financialization at the expense of the integrity of the dollar.

It is known that around 1965, the post-World War II prosperity boom came to an end. This is also the same time where over the next decade, from 1965 to 1975, there were several major social changes, which for our purposes we will focus on the massive welfare expansions through Johnson’s “great society” reforms and then the subsequent decoupling of the US dollar from the gold standard with the opening up of “free trade” with China in 1973 under the Nixon administration that lead to the decline and death of most US manufacturing alongside the expansion of credit. Since this was all intentional, one can argue that the very towns which the US built up during and after World War II- the famous “mill towns” throughout semi-rural areas that today now are too often defined by drugs, crime, degeneracy, broken families, poverty, and misery compiled upon hopelessness -were manufactured from prosperity to decline per economic policy, knowing this would happen but not caring for the consequences because the economic ability to manipulate trade balances was valued more than the people who would be consuming the traded goods.

As one who grew up in the late 1990s and early 2000s before the economic crisis, I saw a lot of this decadence and credit spending as a child, but would not have called it such. Rather, I and many others would have called it “life as normal”, for this is what Millennials and some late Gen-Xers, as well as Zoomers, the arguable children of mostly Boomers and early Gen-Xers, knew to be normal. Life had a certain “pattern” to it, and it was one to follow this pattern if one wanted success. Indeed, there is an argument that can be made that such a pattern was not a bad thing for a time because it was based on a Boomer model of prosperity created by the Silent Generation as a result of World War II prosperity- essentially, one could call it exploiting the benefits of the spoils of war for public use.

But this was not normal, and given the generational gap, few could not have been expected to know otherwise. This is a reason why there is so much anger directed towards Boomers, for giving their children material goods and a pattern of life but not explaining how or why things work, and not giving them a way to fend for themselves if the pattern should fail (because they believed that it would not fail) and that life would continue to go on as normal. In a sense, life always does- even in a war torn zone such as Iraq. The problem is that life is very difficult when one does not know what to do if all one knows is one paradigm to be true.

This was violently exposed in 2007 and into 2008 when after six decades and two years since World War II, and four decades and two years since the Great Society Reforms, and thirty-four years after the dropping of the gold standards and the liberalization of free trade with China that the US dollar was exposed as being insolvent. The reasons for this are simple to understand- a combination of lots of bad debt, questionable financial practices that involved taking debt in the form of mortgages regardless of the viability of the owner to pay back his mortgage, “cutting up pieces” of the mortgage, mixing those pieces in with other mortgages “cut up” in the same way, and selling “bundles” as debt made up of untraceable ownership and questionable stability presented just as good as a Treasury bond but with no way to “re-piece” the trail of ownership if one “link” in the “chain” should default, created a crisis of liquidity and ownership. Nobody could get loans because nobody knew what monies went to who for what, and when this is combined with public debt loads on account of simple overspending and bad financial practices, the result is always the same- default and chaos.

At this point, the US had two theoretical options- she could either allow the economy to slow down naturally and in a Japanese-like scenario, see fluctuating prices along with falling wages and decreased purchasing power that could last decades, or she could service the debts as the way that governments throughout history have traditionally done in such a case, which is to create the money that was needed in circulation to keep people spending, but at a cost of lowering, even if only slightly, the value of the currency itself.

This is the reason why ever since the economy was declared “recovered” in 2009, the US has been theoretically in the middle of deflation. Since it is really a global depression, for the last decade one has seen the manipulation of aggregate demand levels and aggregate asset prices as never before arguably in history. In other words, since 2008, the U.S. and world economies have been slowly circling around the proverbial drain waiting to be flushed into the sewer, a process that if played out, would result in a Japan-like scenario that could last for decades.

However, the U.S. government has been continuing to run massive deficits as it seeks to prop up demand levels by way of “stimulus” spending, but this has simply not been enough to offset the fall in consumer spending. Since 2007, the government has become the “supporter” of all things business, and until recently, propping up all assets, including U.S. Treasuries, by way of “quantitative easing”, which is another way of saying “money printing”.

The Federal Reserve Bank- a private corporation not owned by the government but who controls the money the government issues -knows that a deflationary “death-spiral” as defined by a lack of liquidity (no available cash) will cause less spending, which leads to diminished demand, which leads to more unemployment, which leads to lower consumption, to still lower spending, until the economic machine goes to a halt.

In response, the Federal Reserve Bank bought up assets of all kinds in order to inject liquidity into the system and support prices so as to prevent this deflationary deep-freeze. This has been policy since 2010, and is a “one-size-fits-all” approach”. The danger of this is it sort of like a plumber whose only tool is a wrench- and every problem looks like a bolt or a nut to be turned.

Call it what you want- money printing, quantitative easing, price stabilization -it is all the same result, which is turning on the printing presses and printing money as fast as the machines can put it out (theoretically speaking- most of this is done electronically, so it’s more accurate to say “button pressing”). This is how the Fed has expanded its balance sheet from about $900 billion in Fall 2008, to about $2.3 trillion in Fall 2010 alone- just two years from the “recession” to the “recovery”, and now that it is 2020, to 6.9 trillion

But is this true deflation, where bond yields (interest return) is low, and unemployment continues to grow?

I wish it was. Rather, we need to talk about something I have been warning about for a long time, which is the Weimarian ghost of that horrible word, hyperinflation.

Why? Because the next step down in this world-historical Global Depression which we are experiencing will likely be hyperinflation.

Most people dismiss the idea of hyperinflation occurring in the United States as something only for the mentally ill, conspiracy fantasists, gold bugs, and survivalists. There is a point to this, for there are a lot of foolish ideas who have their own acolytes..

But what I speak of here is not fantasy. This is not about reading “conspiracies”, or projecting a desire onto a situation.

Apart from what happened with the Weimar Republic in the 1920’s, Western economies have no experience modern with hyperinflation. There were plenty of hyperinflationary events in the 19th century and before, but through careful economic management, the “advanced” economies have learned their lessons and so well that it’s been forgotten.

But there are some countries where one can draw experience from. Most talk about Zimbabwe- as so also have I done -but I would like to use a different example, since the case of Zimbabwe is a classic African example of war leading to mismanagement and corruption. I want to turn to Chile, as while in the Hispanic world, it is highly “europeanized” and yet went through a period of hyperinflation during the Allende government in the early 1970s (1970-1973).

In 1970, Salvador Allende was elected president by roughly one-third of the nation. A hard-core Socialist who headed a coalition called Unidad Popular (Popular Unity), under his government socialists, Communists, and assorted left-leaning parties took over the administration of the country and began to radically transform Chile on a road to left-wing socialism.

Salvador Allende

What happened was similar to the Russian and Ukrainian experience under life in the post-revolution days. There were land exproprations, nationalization of companies and mines, and the subsequent failure of them as a combination of corruption and inexperience rendered them unable to be used and just brought to run in the same path that the ZANU followed in Zimbabwe with the confiscation of farms that lead to mass starvation in once the arguably most bountiful food producing nation in Africa.

One of the key policies Allende carried out was wage and price controls. He froze prices of basic goods and services and augmented wages- basically, forcing businesses to pay workers more while refusing to allow them the freedom (in a non-greed oriented sense) to increase prices based on market demand. The most common parallel one can draw in our times to this is the “fifteen dollar” minimum wage laws in certain cities for McDonald’s restaurant workers. Yes, the wages increase, but as one can remember in the American cases (as there are multiple areas in which this has happened), employee hours were significantly cut, a lot of workers were fired or laid off, robotics was brought in to replace workers, and prices for food had to increase to the anger of the customer in order to accommodate the wage increases.

At first, this measure worked, as workers had more money, and goods and services still had the same old low prices. The people loved this, and so did what Americans did with toilet paper leading up to the COVID-19 crisis- they went on a shopping spree and rapidly emptied stores and warehouses of consumer goods and basic products. Meanwhile, Chile’s version of the “McDonalds” experiment detailed above, by forcing private companies to raise worker wages while maintaining their same price structures, caused bankruptcy. Allende then nationalized said companies for “the people” and put them back to work, but with the government spending money to keep them running for the same economic reasons, thus operating at a net loss.

This is where hyperinflation fits in, because Allende printed the money needed to pay for expenses for these state-run companies to cover for his irresponsible policies.

This is how hyperinflation came to Chile. Workers had plenty of cash in hand but it was no better than having Monopoly money, since one could not buy goods with it.

So what followed? Rationing and “ration cards”, with preference given to the friends of Allende. However, with no real economic fix in sight, people did what happens in all countries, which is they started black markets in staple goods, and only accepting American dollars because due to Allende’s policies, the Chilean escudo was worthless.

By 1973, the crisis was so miserable that the stock market and housing market collapsed as people lost everything they had. Nothing was safe from sale on the black market for all practical purposes as people traded very precious things simply for a little food and drink to stay alive. The crisis resulted in the success of the CIA-backed coup that overthrew Allende in September 1973 and installed the dictator Augusto Pinochet.

So having this context, and knowing how serious hyperinflation can be, let’s take a look at deflation and inflation again, and see how the various movements of the economic world differ.

In a deflationary environment, where commodity prices are more or less stable, wages drop, asset prices fall, and credit markets shrink, for in such an environment, there is really no inflation, for one cannot have overvaluing (inflation) if values are dropping. To say such is a contradiction.

Inflation and hyperinflation are thus not merely the same thing. It is not that the latter is on “steroids” but, like the goat and the sheep, two animals that share a similar look but are very distinct.

Inflation is when assets become overvalued because people want them so much. To use car language, it’s when the economy “overheats”. Think people paying one-hundred dollars for a “Beanie Baby” during the Beanie Baby craze of the late 1990s. A Beanie Baby is worth three to five dollars, not one hundred. But, if people will pay one hundred dollars for it, who is to say a business will not charge that? Greed yes, but such is the nature of man. This is inflation as a textbook definition- when an economy’s consumables (labor and commodities) are so “in-demand” because of (theoretical) economic growth and easy access to money (meaning either you are earning a lot, have a lot saved to draw on, or are borrowing the money on credit) that lets people spend money like a sailor in a bar. It is classic “supply and demand”, the “if they build it they will come” mentality.

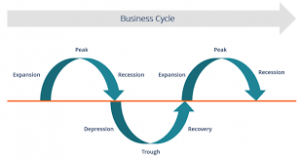

This mentality should not be considered a modern thing either. It has been seen in Europe with the “Tulip speculation” of the 17th century, and was a main reason for the “boom-bust” economics of the 19th century that would destroy wealth as fast as it would create it, since the cycle, while it can be a brutal thing, is actually a natural process on the sine-wave of economic growth, for there is a start, a demand that grows, followed by a peak, a small decline, then a major decline, then a recovery to normalcy, back to interest again that the cycle continues on. This is found in all countries and peoples, and what the desire of government through “central planning’ has always been is to keep the “highs high and the lows gone”, meaning to always push for stability or growth so that money is made and either to minimize or completely eliminate any downturn in the economy so that money is not lost or that what money is lost is lost on people who are poor and not in the “economic club” of the wealthy.

The “boom-bust” cycle of economics as a sine-wave function. It is as natural as life itself, and is the story of economics in every nation.

But hyperinflation? Not so at all, for this is the loss of faith in the currency. Prices rise in a hyperinflationary environment like in an inflationary environment not because people want more money for their labor or for commodities, but because people are trying to get out of the currency -so they will pay anything for a good which is not the currency because the currency is becoming merely worth the paper it is printed on.

Right now, the U.S. government is indebted tremendously, varying from 108% to 159% depending on how it is measured. Pick the percentage you wish, it does not really matter because it is all bad. The reason for this is because the Federal Reserve is printing money to do all things, from purchasing Treasuries in order to finance the fiscal shortfall existing, to bail out the public, and to keep major corporations from having to cease production due to deficits. The overall purpose of this is to try to maintain aggregate demand levels and support asset prices for the benefit of those invested into them. It is a process of the continued financialization of the economy that has been happening since the 1970s.

A deflationary cycle would last decades, and it would be very economically difficult, but with decreasing prices and the resulting job losses and business closures that would follow, it would overall result in the same thing, which is a recovery in the economy by way of a return to “normalcy”.

But this is not going to happen. Forget talk of “double-dip” recessions and that nonsense because the US is still in the first economic “dip” since 2007. No matter all the stimulus, no matter all the “liquidity” injections for over 10 years not, the economy is going down and both the Federal government and the Federal Reserve are going to use the same- and only tool -they have used to fix it, which is money printing.

This is the paradox. It’s these very fixes that are pulling us closer to the edge of a fiscal cliff because they have undermined faith in the currency itself and the ability of the US to service her debts. Treasury bonds? They are useless, and yet they are literally the only thing(s) holding the whole economy together because it is debt being used to service debt that is merely more debt.

We are talking about a financial “minefield” here- one mistake, and the thing explodes.

So then, how could hyperinflation happen?

First, there needs to be a reality check. It won’t be forever, so forget about Mad Max type scenarios, for those are fantasies of films and not reality.

Second, realize that life will go on, and America will be pretty much like it is today, with more poor people. In reality, at this point, as I have noted, hyperinflation is probably the only way that the economy will (in a practical sense) reset to better times, as a collapse in the currency, just like with a true bankruptcy, abolishes debt.

Third, the same rules of history apply. The famous saying “Buy when there’s blood on the streets” is the literal truth in this point. The best way to prepare for this is, in my personal opinion (and not giving any sort of financial advice, but just observations on the counsel of history) to lower personal debts, purchase useful commodities, and consider tangible assets that preserve value such as metals and even one may also regard land as doing the same.

Fourth, in hyperinflation, asset prices don’t skyrocket save on paper. They collapse, both nominally and in relation to real commodities. To use an example with housing, a $500,000 house falls to $70,000 or less, or better yet, 50 ounces of silver becomes something that can actually buy you expensive stuff you normally could not purchase in “normal” times such as land or heavy machinery.

Likewise, I’m not saying “when” this will happen, and hopefully there may be intervening circumstances that delay or even partially hinder the potential of paying $500 instead of $5 for a Starbucks latte. What happens after is also anyone’s guess, since while there are patterns, it would function in harmony with political changes, which can mean anything from a decline in currency value repegged against the old currency for a buyback (such as “buying back” into the new currency at a 30% discount such as what happened during the Great Depression), or an outright dictatorship with wage-price controls.

My observation is that no matter what happens, the current situation cannot continue. The Global Depression we are in is being exacerbated by the very measures being used to fix it, and in a story like this one cannot have a good ending.

The way that any of such crises will happen will be with an event. Right now, COVID-19 is being blamed for “destroying” the economy, but in reality just exposed the rot that was already there. The printing of money under COVID-19 with an upcoming second stimulus check is also only going to worsen the current scenario.

So let’s take this into consideration- how could this happen, an using COVID-19 as an example?

One word: homes.

Before the emergence of Mortgage Backed Securities (MBS), most mortgages were issued by a local savings or loan company. The note of debt usually didn’t go anywhere save down the street. But once mortgage loan securitization happened, things fell apart.

Basically, what happened was personal mortgages were sold off in “slices” in bundles with other mortgages. These were “bundled” into special arrangements designed to hold the loans for tax purposes and sold off as bonds with safety equivalent to those issued by the US treasury, backed by the ability of people to pay their mortgages.

But the big question- what happens if people borrow more than they can, or lie on their statements of assets, or lose a job?

Here is the sinister part. When an MBS was first created, all the mortgages were in good standing because they were all brand new loans. Statistically, some would default and some others would be paid back in full, but no one knew which one or how. Yet by the process of “cutting up” these loans into multiple “bundles”, nobody knew anymore who had ownership of what part as there were so many scattered pieces.

To use the example of the Three Stooges (since this is the level of financial mismanagement we are talking about) consider that a man gets a mortgage. His bank sells his mortgage note to Moe, who sells a piece of it to Larry, who chops another part off and sells it to Curly, and all our notarized signatures are actually, physically on the note, one after the other as holding a share of the profits from the same mortgage note. If for whatever reason, the original holder skips any payment, then the chain of title is said to be broken. Therefore, legally, the mortgage note is no longer valid. That is, the person who took out the mortgage loan to pay for the house no longer knows whom to pay. The result? The bank just forecloses on the man who failed to pay in an effort to get money back for the Three Stooges without giving him ever a change to remedy his situation. The Stooges walk away with at least some money back in their pockets, and the common man suffers a debilitating financial loss.

The Three Stooges in “Jerks of All Trades.” Unfortunately, the mess they make in this presentation in modern times involves money, and instead of being painters, they are financial brokers in suits.

But this is just the start. Expand this to real estate, and rental properties for landlords. If COVID-19 puts people out of work, how can anyone pay? Likewise, what happens if businesses cannot pay their mortgages or rentals on commercial real estate, who are also indebted to banks? Likewise, what happens when multiple mortgages owned by separate people are bundled together?

Do you see the can of worms that’s opening up? We are talking about a chain reaction like a nuclear bomb. No job —> cannot pay rent/mortgage —> forces foreclosure/eviction —> cannot get renter to make up difference —> disrupts ability of landlord/company to pay for his mortgage —>forces foreclosure —> big real estate goes back to bank —> bank tries to sell it —-> nobody wants to buy because no money and too big —> real estate falls to disrepair —> now nobody wants it —> prices have to go down —> people lose money, including banks —> people need money for a bailout like the rest of the country —> more bailouts devalues the currency —> the devolution of the currency means more poverty and job losses and back to he beginning.

This is not a recovery. This is a death spiral that we are circling.

It is estimated that 33% of renters or 12 million people, to make their full payment in July, meaning that 12 million could be on the cusp of eviction in a matter of months. In total, about 40 million- or about the size of Poland as a nation -are at risk of losing their homes. In addition, landlords are set to lose billions of dollars this year over the inability of tenants to pay rent.

This year alone, tens of millions of Americans were pushed into instant poverty, many face housing insecurity and homelessness as the labor market recovery reserves. This has led to millions of permanent job losses. Many Americans already had insurmountable debts and no savings, because they simply could not due to rising prices and a dead economy.

But this is nothing. Watch as more big corporations are go bankrupt, more businesses fail, more workers are laid off, and the financial dominoes start to fall at lightning speed.

Over the last 4 months, more than 50 million Americans have filed new claims for unemployment benefits, mostly with the specter of a permanent job loss looming. As we reported, one survey from USA Today discovered that 47 percent of all unemployed workers now believe that their “job loss is likely to be permanent”.

This isn’t a joke. People are really suffering and are going to suffer more in the future, and this is why I have been warning this Christmas there will not be a Christmas “sleigh ride”- such as going through the snow on a horse-drawn sleigh that is popular in American lore -but rather a “slay ride”, implying violence and a sort of butchery found in a horror film, except this time the film is real life, and the slaughter will be to people’s personal finances and the retail market since being forced to spend money on essentials such as food, water, and utilities, and maybe not even having enough for that, the retail sector is going to be absolutely decimated since 25% to 40%, as I have noted before is made in the time from Thanksgiving to Christmas. With most likely poor sales for the future, there will inevitably be more layoffs, more job destruction, and more poverty.

If one wants to see what the retail sector is going to look like, one only needs to go to a local mall. Many of them are dead or dying as evidenced by the ongoing store closures, the proliferation of people “hanging out” but not shopping (as in looking for a warm place to stay, not actually going there for leisure purposes) has continued to grow, and the fact that many of the stores are disorganized, dirty, or just falling apart. The mall, being a creation of the consumerist post-World War II economy is, like the post-World War II world, falling apart at the seams.

So what is the answer from Congress? Two words, as noted before: money printing.

Consider that in the last few months, the US printed more money than all that was printed in the first two centuries of the US’s existence.

“The United States printed more money in June than in the first two centuries after its founding,” Morehead wrote. “Last month the U.S. budget deficit — $864 billion — was larger than the total debt incurred from 1776 through the end of 1979.” (source)

Buy why continue to print, if it will destroy the economy? As noted above, to question money-printing as the one-size-fits-all solution to every economic problem is to question the power structure of the status quo and the only tool used to manage said problem. Basically, it is telling the plumber with the wrench he needs a different tool, but since he has no other tools, he doubles-down and insists on using the wrench.

But what happens when people cannot pay their bills and still do not have a job? They already are going to get two checks- essentially 2007-type bailouts.

Who is to stop a third?

A fourth?

A fifth?

Money being thrown out of helicopters?

There is nothing. Nothing at all. The people figured out they can print themselves the treasury. Historically speaking, there is a point in any human society that people can get the idea into their heads that they can “print their way to prosperity”, sometimes also called “voting themselves the treasury” while providing less than what is required to sustain those benefits. This means in every case death for a society because it destroys the value of the means of exchange in one case, and in a more insidious example, in the name of “fairness” it can create polarizing factions that demand special fiscal handouts, to which other groups form and demand “justice” in the form of equal handouts, until eventually the money runs out, people become angry, and start fighting. In both cases, the trust needed to sustain a society is destroyed, and chaos results that has to be restored by a new currency and many times, since economics is the predecessor to political change, a new government has to be instituted to restore the loss of order.

For people wondering, the US has already been on this road for decades, beginning with the ponzi scheme of Social Security, for while it was well-intentioned and may have worked in select cases, the philosophy, composition, and size of the US make it very difficult for such a system to successfully function in the US without causing a complete breakdown at some point. The “Great Society” programs had a similar effect, for while it is true that all societies give welfare, the welfare given was not managed through churches or based upon available resources, but was funded through financialization at which the root was money printing. It is one thing to help people with money that one has, but an entirely different matter to do the same thing but on credit that one cannot pay back without destroying one’s own finances. This is not even a matter of taxation either, since the taxes collected do not even pay into the actual programs, but rather are interest payments to the Federal Reserve Bank (a private company) on the money that they loan to the US government at her request to run said programs.

Thus the argument of “my money is going to welfare junkies” (as so many will say) is absolutely not true- the problem is not “those people on welfare”, but rather the criminally irresponsible financial policies and practices that “we the people” voted for and have continued to accept because it provides to the public the surface benefit of “extra wealth” by letting the same individuals buy fancy cars, nice homes, take big vacations, and dine luxuriously through borrowed money to be paid at a later time but which mathematically can never be paid off lest the value of the money itself collapse. Welfare is not ultimately paid for by taxes and arguably has not been since 1973, as it has all been paid for by money printing.

But to stay on the topic of “welfare junkies”, the biggest of such are not poor people in apartments in the inner cities or trailers in the woods, but are the very same corporations and their CEOs that are called “captains of industry” and “business leaders” that Americans are told to hail as intelligent and model citizens. These people are largely not leaders or admirable, but criminals in suits and with lots of servants to help them perform their actions (whether those working for them realize the totality of what is happening or not). The reason for this is because it is they who lobby for either lower taxes for themselves or for increased tax schemes so that they can force average to small business owners out of business through excessive taxes while at the same time through as series of deceptive accounting tricks (like the “Double Irish” or the “Dutch Sandwich”) pay little to no taxes at all, thus having the effect of paying less while it appears to the public that these are “responsible corporate citizens” who are encouraging “their fellow businessmen” to “pay their fair share” since they are “good patriotic American citizens”, when the reality is they are just con men peddling dishonesty and criminality for their own gain at the loss of everyone.

Back in 2007, when millions of people had their finances destroyed by the crash, did the public receive a financial bailout? Absolutely not. Instead, it was major corporations who received it in the form of the TARP plan.

Now it should be made very clear that the bailouts were not good, and they should never have happened. However, noting this, if major companies were bailed out at the ostensible taxpayer expense and thus putting the country on a long-term road to either a very painful deflationary depression that would likely persist for decades or the more likely chance of hyperinflation, why should the general public, who was deceived by these same companies and politicians for years, not receive a bailout too?

The only way to fix the financial problems, regardless of now or 2007, was to fix the debt issue, and the only way to do this would be either to pay it back- which is mathematically impossible because of how the Fed system works -or to declare a jubilee, disown the debt, shut down the Federal Reserve Bank, arrest the officers of the bank, and seize control over money creation, which would plunge the US into about a decade of financial disorder but would be long-term healthy for the country as it would reset the currency and allow asset prices to stabilize and permit for real value to be created so that all men and companies, small or big, could benefit for true long term prosperity.

But that is not what has been allowed to happen and is likely not going to be allowed to happen, and especially at the current time. The only way to fix the current problems of the system is either a debt jubilee or to allow it to be run as it is until it naturally and inevitably will collapse. In both cases, such will be at a point when the debt can be disposed of and the economic system rebuilt.

This has been the greatest benefit of COVID-19 and the ensuing first and soon to be second stimulus check that will follow from Congress. Some people complain as to why the government is “giving away taxpayer money”, when not only is the reality that the government is just printing money and handing it out regardless of what the taxpayers give, but if the government will give nearly limitless amounts of welfare to major corporations for decades yet continue to force the common taxpayer to pay ever more money to the government, what reason is there that the taxpayer, who is most likely (based on statistical analyses about debt per person) overloaded with debt, should not be given a financial bailout too? Legally speaking companies are people in the US (“non-human persons”), so if a non-human person can get a bailout, is it not more important that “human persons” receive them, since societies are made of people? There is no real argument, if one supports the bailout of corporations, not to bail out the general public, because the philosophy is the same, and if the government will insist upon bailouts for companies, it is hypocrisy to deny the common man what a company would receive.

The end of the world is coming for the US economy as we understand it through a post-World War II paradigm, and that is something which all must accept but is not necessarily a bad thing, as all things come to an end. The real trick, however, is to prepare for after the end of the “apocalypse” because life must continue on- it will go on in the middle of chaos (as it does in any war zone) as well -and how one prepares will determine one’s future after the crisis is over, and likely as in the case with World War II for many decades to come, so the impact will last beyond one’s life and extend to family and future generations.

The discussion of how to handle this for specifics is another topic for a different time. But returning to the issue of inflation versus hyperinflation, the concern now is not to fight policies being instituted or to make bold public statements- since these rarely do any good unless there is already an organic or manufactured groundswell of support guiding the end goal that such a public declaration would support to the exact same end -but to focus on the current fiscal path that has been chosen and is going to be chosen. Hyperinflation is not the choice of most people, but rather it is the choice being forced on the average citizen that he cannot control happening but rather how he deals with in based on the current circumstances.

For example, say that you are placed in front of a massive floodgate. The gate is going to be opened upon you, and you cannot hide from it. You are going to get hit by the water and it is going to knock you around, and there is no way to avoid this. However, you have twenty-four hours to prepare.

What would you do? Would you just “show up” to the gates and do nothing? Or instead, would you take some precautions? For example, you could buy a lifejacket. But would you stop there? Would you possibly consider with that lifejacket a helmet to prevent head trauma, and maybe a wetsuit too? If you had the money, would you consider investing in a pair of goggles and even maybe some flippers so you could swim? If you had a lot of money and wanted to try to make the best, would you consider purchasing a set of scuba gear so that you could swim with the currents and even explore them?

The choice is for you to make, but at the very least, a good lifejacket is in order because if you have that, you may lose consciousness, you may be cold, you may have a lot of pain to endure, but it is very, very unlikely you will drown. This is something that all people can do for themselves that is very effective.

Take this same example and apply it to the situation of the financial markets with inflation and hyperinflation. Most people are not rich and cannot afford a lot of the expensive measures that those with greater financial means could employ. However, they can take basic measures to protect themselves.

Hyperinflation is not a fun thing to think about. However, it is real, it is historical, it can happen to anyone, and knowing the principles by which it can come to pass helps one to avoid its effects. Knowing the signs of the times, it would be wise to pay attention, as the signs are becoming too clear.