Children sometimes uses phrases such as a “bajillion” to describe money amounts that are too large to understand, and at this point it is arguable if such language should be employed at the Federal Reserve, which according to the Wal Street Journal notes has reached a record over $3 trillion dollars and climbing.

The U.S. deficit tripled to a record $3.1 trillion in the fiscal year that ended Sept. 30, as the government battled a global pandemic that plunged the U.S. into a recession in February, the Treasury Department said Friday.

A surge of federal spending to combat the coronavirus and cushion the U.S. economy, coupled with a drop-off in federal revenue amid widespread shutdowns and layoffs, contributed to the widening deficit. As a share of economic output, the budget gap in fiscal year 2020 hit roughly 16.1%, the largest since 1945, when the country was financing massive military operations to help end World War II.

The widening deficit has stirred concern among Republicans in the Senate, who have balked at a White House proposal to spend $1.88 trillion more to spur a recovery from the steepest economic downturn since the Great Depression. Many economists and Federal Reserve officials say restoring growth should be the first priority, and that worries about closing the deficit can come later.

“Unprecedented times call for unprecedented deficits,” said William Hoagland, senior fellow at the Bipartisan Policy Center, a centrist Washington think tank. “Today’s deficit figure is the result of six months of fighting the pandemic and its economic fallout.”

Investors have shown scant concern about the deficit. U.S. government bonds were little changed Friday, with the yield on the benchmark 10-year Treasury note ticking up to 0.743% from 0.730% Thursday, according to Tradeweb. Yields rose in the morning after better-than-expected retail sales data but fell after a disappointing report on industrial production.

Federal receipts totaled $3.4 trillion, a 1% decline from the previous year, with much of the drop occurring since March, when the virus began spreading across the country. Federal spending rose 47% to a record $6.5 trillion as the government distributed emergency loans for small businesses, and enhanced jobless benefits and stimulus payments for American households.

Federal debt rose 25% for the year, to $21 trillion at the end of September, from $16.8 trillion at the start of fiscal 2020. The Committee for a Responsible Federal Budget has estimated debt hit 102% as a share of gross domestic product, exceeding the size of the economy for the full fiscal year for the first time in more than 70 years. (source)

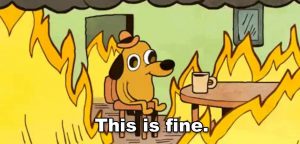

I have noted this is a major trend to watch for, because as the debt gets out of control, it is going to completely suffocate the already eviscerated economy. This trend cannot be overstated because the US is the holder of the largest debt in world history. There has never been a debt this large, and when it is forcibly discharged (since paying is not an option), it may be the proverbial spark that helps set the world economies alight that culminates in conflict.

Debts matter, and so does the ability to pay them, and if they cannot be paid, then major fights and consequences naturally follow.